A total of 300 UK-based companies shared their budgets and outlook for the IPA Bellwether Q2 report which found no change to available marketing budget expenditure, with the net balance falling from +8.7% to zero. Meanwhile, 20% of the respondents said greater marketing spend was completely offset by those cutting expenditure, while the remaining 60% of panel members kept their marketing budgets unchanged since the first quarter.

The IPA also reported that 34% of respondents were pessimistic about future budgets while just 8% were optimistic about marketing spend.

The IPA stated the level of political uncertainty around Brexit and UK leadership, currently between Conservative candidates Jeremy Hunt and Boris Johnson, has delayed client decision making and halted budget spend. Companies surveyed also raised concerns that “difficult conditions” domestically were “damaging consumer confidence and impacting consumption”.

Businesses were also “wary of spillover effects” into UK markets from global trade disputes and weaker growth at key export destinations such as Europe and Asia.

“The expansion in marketing budgets during the first quarter proved short-lived, but developments in the wider economy during Q2 have shown that more intense challenges lie on the horizon for UK businesses,” said Joe Hayes, an economist at IHS Markit and author of the report.

“Firms have subsequently adjusted to this, belt-tightening in some cases and withdrawing into a wait-and-see approach once again. Given the economic and political uncertainties that remain at large, a neutral stance towards budget setting appears fully justified,” he continued.

However, despite the stall in marketing spend, the IPA still predicted a 1.1% annual increase in ad spend over the next 12 months.

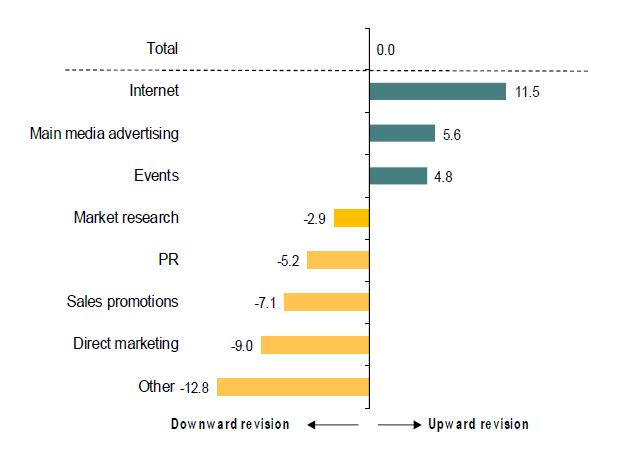

There has been growth in several sectors at a reduced rate compared to Q1. Internet marketing budgets saw net growth of 11.5% (down from 17.2% in Q1). Internet search and SEO budgets continued to grow at a reduced rate of 9.9% (down from 14.2%). Main media budgets rose in the quarter to 5.6% from 5.2%. The events sector also saw growth, up 4.8% from 3.4% in the quarter.

Industry comments

Julia Smith, director of communications, Impact: “In a year of politico-economic uncertainty it was always expected that 2019 would see modest growth; social media aside which continues to see significant spending increases. Perhaps more surprising was the rise in negative own-company financial prospects. I personally think any effect will be negligible but there was always going to be casualties of the overpowering and money-draining duopoly on some businesses. Companies need to continue to diversify and expand their partnerships to generate strong areas of revenue. This, along with the generally improved forecast in 2020 will keep momentum and hopefully spend continuing to increase through to the end of the year.”

Steffen Svartberg, co-founder and CEO, Cavai: “The IPA Bellweather report predicts muted growth in the second half of 2019 in light of the ongoing and uncertain Brexit negotiations. However, it is not all bad news for marketers and the ad industry, as there is strong growth in certain sectors such as social media and digital. In a climate in which both marketers and users are demanding trust, transparency and brand suitability, we all, as an industry have to ensure that we remain committed to delivering these crucial elements if we are to sustain growth across the entire digital ad market. The good news is that digital advertising is still the sector reporting the strongest growth and as long as marketers remain committed to buying fraud-free, performance led brand-safe quality inventory, they can expect this sector to deliver strong ROI.”

Mattias Spetz, MD EMEA, Channel Factory: “The IPA Bellweather report predicts muted growth in the second half of 2019 in light of the ongoing and uncertain Brexit negotiations. However, it is not all bad news for marketers and the ad industry, as there is strong growth in certain sectors such as social media and digital. In a climate in which both marketers and users are demanding trust, transparency and brand suitability, we all, as an industry have to ensure that we remain committed to delivering these crucial elements if we are to sustain growth across the entire digital ad market. The good news is that digital advertising is still the sector reporting the strongest growth and as long as marketers remain committed to buying fraud-free, performance-led, brand-safe quality inventory, they can expect this sector to deliver strong ROI.”

Damon Reeve, CEO, The Ozone Project: “It is little surprise that the latest report shows no overall growth in the current economic climate. However, it is promising to see that internet marketing continues to perform as the most effective mode of marketing, showing signs of steady growth (+ 11.5% from the last quarter) and this is expected to rise in 2020. Over a quarter of those surveyed recorded upward revisions to their advertising spend despite overarching budget cuts. This is consistent with the current demand from our clients on their media ad spend. What we’re seeing is a heightened appetite amongst advertisers to reach engaged audiences at scale through brand-safe and trusted content environments, and in turn, this is giving agencies the confidence to do the same.”