The latest Advertising Association/WARC Expenditure report was published at the time of the Advertising Association’s LEAD summit for the UK’s ad industry at the QEII Conference Centre in Central London.

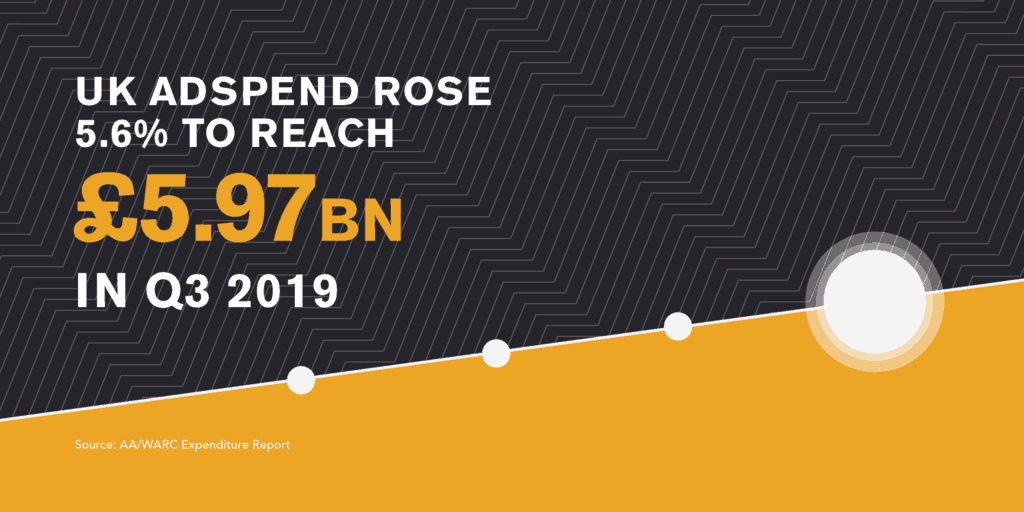

The findings revealed that growth in the third quarter of 2019 was 0.8 percentage points ahead of forecast.

Looking ahead to the full-year figures for 2019, UK ad spend is forecast to reach £24.8 billion, meaning growth of 5.2%. This is expected to rise a further 5.2% in 2020 to reach £26.1 billion.

The figures stated were a result of increased spend on online advertising, which saw percentage increases across every format.

Attributing to this, the increased spend in the channel was led by digital out of home, which rose by 17.1% followed by TV broadcaster VOD which saw a rise of 16.7% and national online news brands (6.5%).

The report also demonstrated particularly strong growth in Q3 2019 compared to the same quarter in 2018 in cinema advertising, which saw a very impressive rise of 46.5%.

The online figures reflect the recent Advertising Pays 7: UK Advertising’s Digital Revolution report from industry’s think tank, Credos. The report revealed that Britain is the largest online advertising marketplace in Europe and that the country has the highest per capita online retail spend in the G20.

“UK media spend has continued to perform strongly in Q3 2019, now on the twenty-fifth straight quarter of growth. The figures show ad spend increases across a range of media with digital formats and sectors continuing to drive growth. These media spend figures are particularly impressive given this was a period of Brexit and political uncertainty and very low overall economic growth. As the Credos report on UK digital advertising showed, this is in part fuelled by the exceptional growth in SME spend in digital, as well as larger advertisers continuing to move budgets into digital formats in most media sectors. The projected growth for 2020 shows these trends continuing. With Brexit now a certainty, industry’s focus now turns to the future relationship with the EU and the importance of this to the overall health of the economy, which underpins these media spend growth,” said Stephen Woodford, chief executive of the Advertising Association.

“The UK’s ad market has sustained a 25-quarter period of expansion, but underlying data show that this growth is asymmetric – excluding online advertising, the UK’s ad market has contracted each quarter for the last four years. Online formats account for three in five pounds spent on advertising in the UK, and we expect this to rise to two in three by mid-2021, fuelling total market growth in tow,” commented James McDonald, data editor at WARC.

Industry reaction to UK advertising growth

Kirsty Giordani, executive director, International Advertising Association (IAA), UK: “With ad spend rising more than 5% in Q3 2019, we have a reason to be positive, but we can’t afford to be complacent.

“To maintain our creative edge and talent-attracting environment in a post-Brexit UK, the ad industry must be prepared for potential challenges from Q1 2020. These could include budget cuts, changes in campaign priorities, and disruption to the ebb and flow of homegrown and overseas talent. Regulatory enforcement from the ICO is also expected to increase this year, with the impact felt by the ad-tech industry and advertisers alike.”

Jeff Meglio, VP global demand, Sovrn: “UK media spend is continuing to perform strongly, propelled by increased investment in online advertising. With this growth predicted to continue—UK ad spend is forecast to rise 5.2% in 2020—we can expect a stronger emphasis on the quality of online inventory moving forwards, driven by increased data privacy regulations.

“More than this, we can expect advertisers to spend more carefully, narrowing the number of partners they work with, and transacting in more consumer-friendly, transparent ways. This will lead to both supply and demand partners seeking differentiation in an effort to stay relevant.”

Chris Hogg, managing director, EMEA, Lotame: “It is not surprising to see an uptick in online advertising as advertisers are focusing on ways to meet modern audiences where they are, and connect with them in meaningful ways. Despite the current market climate, it’s encouraging to see marketers are not afraid to play around with different formats and creative opportunities, such as DOOH. This reflects the general consensus that audiences are, and will continue to be, spread across different media and platforms, generating multiple touchpoints and data sets.

Thanks to these digital technologies, marketers and advertisers today can have access to incredibly detailed insight which enables them to target increasingly specific audiences. Fittingly, Lotame has seen a 28.9% rise in data-related investments during Q3 in 2019 as brands seek to enrich their own data to find new customers but also to create a more panoramic view of their existing customers by tapping into different data sources.”

Jeff Pfefferkorn, head of sales, UK, MainAd: “The annual rise in ad spend is certainly encouraging especially at a time when declining footfall is hitting UK high streets hard.

Digital media continues to be the main driver of growth with channels like Online Display experiencing an exciting 12.6% YOY uplift. This space is particularly interesting to watch because, as it becomes more innovative and sophisticated, it offers brands and advertisers the opportunity to experiment with different formats and reach consumers through truly dynamic campaigns.

The benefits of these technologies – better measurement, increased transparency and ultimately higher ROAS – are also leading to further investment in mobile as a result of the strong link between in-app advertising and product search and ultimately customer conversion. It is this shift in the devices we use to power our discovery and eventual purchase that presents a golden opportunity for brands to remain top of mind even when consumers are not online or in a physical store.”

Libby Robinson, managing director EMEA, M&C Saatchi Performance: “Digital’s impact on the growth of ad spend is unsurprising and promising for our sector, it’s also a reflection of the high accountability we’ve achieved as a collective. Advertisers are focused on quantifiable results and leveraging platforms and channels they know can deliver return on investment, and we expect them to hold on to this outlook in 2020.

“Advertisers will continue to utilise sophisticated tools to improve performance and to measure, at a granular level, along the entirety of the marketing funnel. The industry-wide movement towards greater transparency will make building a view of performance across all touchpoints easier for brands, which in turn will lead to greater efficiency and further investment growth.”